Data enrichment is the process of taking data in its raw form and improving its accuracy and reliability. Usually, this involves ensuring that the data is consistently updated and formatted correctly. By enriching data, companies are able to make better decisions as opposed to relying on raw data that has not been cleaned and verified.

Data enrichment varies amongst different industries. For example, consumer-facing businesses might have an easy time enriching data by simply updating customer email addresses and phone numbers. However, other industries – such as wealth management – have more elaborate needs such as matching transactions to holdings or gaining access to an expanded set of security attributes in order to enhance the user experience.

How does data enrichment impact wealth management?

Data reigns supreme in today’s fast-paced business environment. Companies that can harness their data most effectively will inevitably gain an advantage over their competitors. This is especially true in the wealth management industry as more firms focus key initiatives on digital transformation in order to drive better client engagement to fuel growth.

To power next-generation solutions for their clients, wealth management firms rely on accurate and timely data. In particular, many financial technology companies depend on accurate client and investment account data that is updated daily to fuel their experiences. Without access to this rich data, they will not be able to provide the most value to their customers/end-users.

Furthermore, gaining access to this data is oftentimes difficult, as it resides in many different systems in inconsistent formats, and managing it all can be labor-intensive and tech-heavy. Firms that rely on multi-custodial data feeds often lack access to rich data, due to the fact that each custodian individually offers different data elements with varying degrees of quality. Time spent on the ongoing management of these feeds can greatly affect the quality of the final product as well as the team’s capacity to address product differentiation.

In most cases, it’s not cost-effective or value-add for these companies to understand the nuances, processes, and methods of each custodian. Instead, they outsource this part of the business to third-party providers, like BridgeFT. This ensures that they get direct access to high-quality, complete and accurate data. Plus, it saves them valuable time and resources.

What is data enrichment and how does it work?

For BridgeFT, data enrichment is a key part of our data aggregation and normalization process. It is our secret sauce to ensure data consistency for the vast array of client use cases we support—from trading and rebalancing, direct indexing and securities-based lending to advanced advisor platforms and compliance and regulatory needs.

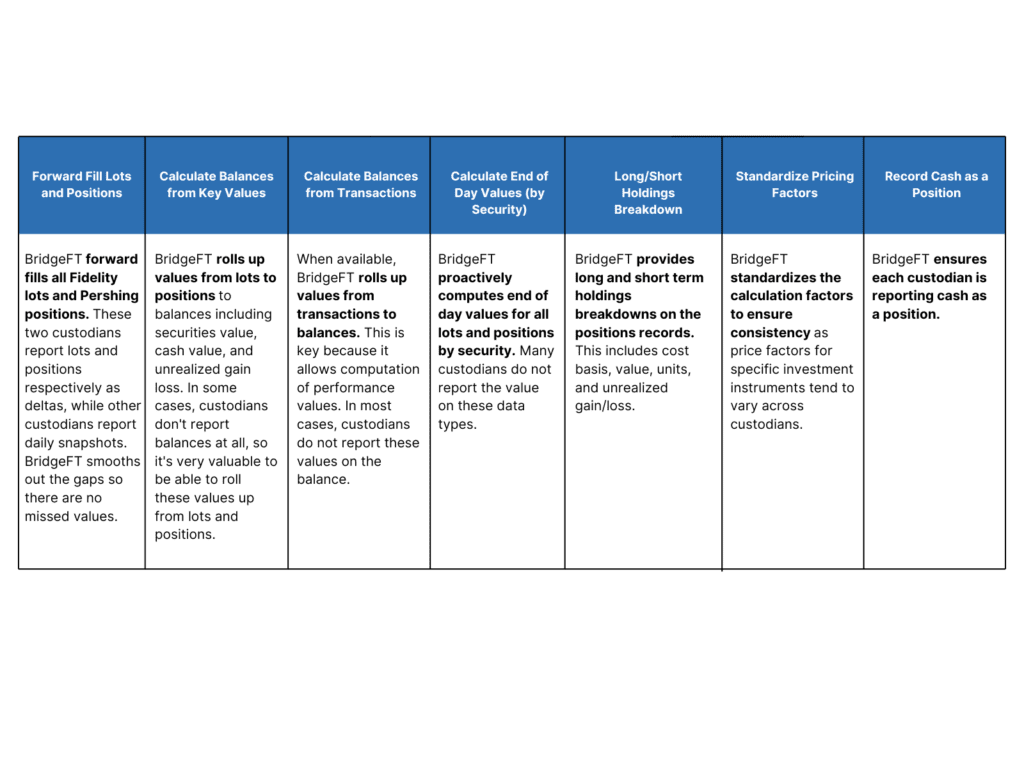

Almost all custodians have their own specifications on how their data is to be delivered and what data elements are made available. BridgeFT works closely with each provider to identify known gaps or incomplete values, and proactively enriches the data to ensure consistency. Here are some of the ways that BridgeFT enriches data:

BridgeFT’s approach to enriching data

BridgeFT’s WealthTech API is a modern, digital wealth infrastructure platform that starts with rich multi-custodial data as the foundation. As an API-first platform, financial data enrichment is one of the core tenets of the platform and a key area where BridgeFT excels over other providers.

One common data-specific problem in the wealth management industry is that each custodian reports data differently. This can create a nightmare scenario for companies attempting to dig through and utilize this multi-custodial data themselves.

To address this issue, BridgeFT transforms the data into a single data model, so that it’s easier for our clients to interpret. This way, our clients can handle accounts in the same exact way regardless of which custodian they came from. For example, BridgetFT always ensures that prices match values regardless of what data the individual custodian provides.

Additionally, BridgeFT further enhances the core data by automatically calculating performance using both Time-Weighted Return and Internal Rate of Return on all accounts, regardless of custodian. This ensures that all necessary returns can be viewed by the end-user to provide the highest quality experience.

Why do we do this? BridgeFT offers the highest level of data enrichment available on the market so that our clients are free to limitlessly innovate. Our proven process eliminates the time and resources typically spent on data standardization and ongoing management.

Now let’s examine a few other aspects of BridgeFT’s unique data process.

Delivering Unified Data

When it comes to enriching data, most companies don’t want to worry about learning the nuances of each custodian’s data offering and processes. They just want to receive the data in a digestible, effective format so that they can focus resources on developing their core product.

To help our clients achieve this, BridgeFT delivers a unified set of data by automatically filling in essential gaps in the source data and removing all potential bad characteristics based on individual custodian variance. This ensures that the only thing our clients experience is clean, accurate, and timely data that is both trade-ready and analytics-ready.

Here are a few ways that BridgeFT delivers cohesive data:

- Eliminating unpredictability: Ensuring that all data is delivered in the same schema which shields customers from custodian variability. Regardless of the source, we standardize the data into a single format, so that clients do not have to deal with inconsistencies.

- Removing “bad characteristics” from data: Not all custodians handle their data with the same level of care. For the end user, this can result in headaches and hours spent manually updating and reconciling data. BridgeFT automatically removes the “bad characteristics” of custodians who have a high number of inconsistencies in their data.

- High fidelity of data: BridgeFT’s platform is able to offer a detailed depth of data and expose key data elements that other legacy providers do not offer such as tax lots, cost basis, UGL/GL, TaxID/SSN tokens, client profile information, and more.

- Standardizing data: Naming conventions can become very complex with multiple exchanges and custodians. BridgeFT helps make this consistent and centralized for our clients. Some examples of data points we standardize include transaction codes, account types, and security types.

Enhanced Support

The BridgeFT team works behind the scenes handling data to ensure that clients don’t need to do a thing. A perfect example of this support played out during the recent TD to Schwab conversion.

For those not familiar, Charles Schwab recently acquired TD Ameritrade. As a result, all TD Ameritrade clients, advisors, and accounts were moved from TD Ameritrade to Charles Schwab. During one weekend, 3.6 million accounts across 7,000 RIAs were moved from TD to Schwab Advisor services. It was one of the largest data migrations attempted in any industry, let alone in financial services.

Despite the size of this migration, BridgeFT clients did not have to incur any additional work during this process. Additionally, by leveraging BridgeFT’s data continuity approach, clients were able to resume business as usual before, during, and after the Schwab TD merger without it impacting their previous processes. This is due to the fact that when using the WealthTech API, all accounts are provided a unique identifier regardless of the custodian. On the other hand, companies that rely on internal custodial feeds or had less proactive providers were left figuring out the transition themselves.

Rest assured that BridgeFT always delivers data that is the best it can provide. We hope that you’ve found this article valuable when it comes to learning about financial data enrichment and how BridgeFT provides the highest level of data fidelity and service to our clients.

Learn more about BridgeFT’s solutions and read stories from leading fintechs utilizing our WealthTech API platform.