Company Overview

The client is a Fortune 1,000 bank with a large private wealth arm which manages billions in AUM.

Executive Summary

A Fortune 1,000 bank was experiencing operational challenges as their prior data partner was discontinuing institutional data solutions. The bank conducted an evaluation process and ultimately selected Bridge as their new data partner. Bridge led the entire implementation process for the firm, successfully integrating improved data feeds for their client portal and ultimately supporting the bank’s path to becoming acquired.

Challenges

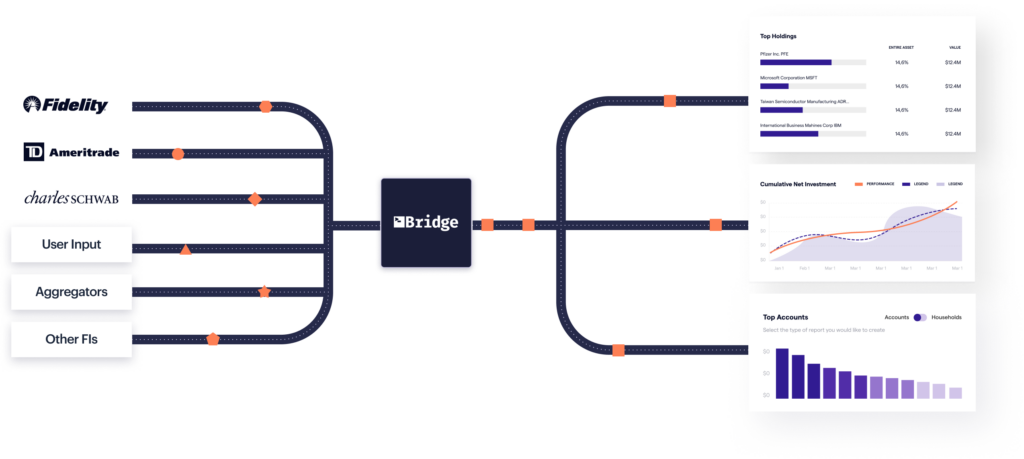

Prior to working with Bridge, the client was leveraging another service partner to feed data including accounts and performance information into a proprietary client portal. Clients were enabled to view their account status and performance via the online portal. Data management and integrations was never a core competency for the firm, so leveraging an effective partner on this front was critical for their operations to run smoothly. Their previous provider announced they would no longer service the data management solution, prompting the firm to begin a search for a new service partner. The firm considered Bridge as a contender to manage their data feeds moving forward. After considering several solutions, it became clear Bridge offered the firm the most value with the highest quality data, superior delivery mechanisms, and the fastest deployment timeline. The client noted how important it was for them that Bridge could deploy the entire solution in a matter of weeks, while other providers quoted a timeline of 6-12 months.

Bridge could deploy the entire solution in a matter of weeks, while other providers quoted a timeline of 6-12 months.

Solution

Bridge handled the entire onboarding and implementation process, beginning by identifying which data the firm needed, in what format, and in what frequency. During the onboarding process it was uncovered that the prior data provider had not been performing as the client previously thought–delivering incomplete data sets. No one at the organization was aware that the prior provider had not been sourcing data from two of their key custodians. This means that incorrect and incomplete data was previously being delivered to their end-client’s user portals. Bridge remedied all the legacy data issues, resulting in 32% increase in data coverage for the client. The Bridge team then conducted a rigorous Quality Analysis process to ensure the client was configured for future success. With Bridge’s improved processes, the client no longer had to be concerned about receiving incomplete or incorrect data sets.

During the onboarding process it was uncovered that the prior data provider had not been performing as the client previously thought–delivering incomplete data sets. Bridge remedied all the legacy data issues, resulting in 32% increase in data coverage for the client.

Results

The entire process implementation took just six weeks to rollout. By fixing data issues from the previous provider, Bridge immediately eliminated the possible compliance and quality issues around data. Additionally, the improved data delivered to the client portal improved client engagement and supported the organization’s ability to scale without operational limitations. The firm eventually went on to be acquired and continues its partnership with Bridge today. On an ongoing basis, the client does not have to spent any time managing custodial data and the firm has peace of mind knowing all data processes are taken care of proactively.