Direct Access to Multi-Custodial Data Unlocks Greater Personalization and Deeper Analytics Across Tax Smart Portfolio Construction and Rebalancing Suite.

Company Overview

The startup is a quantitative investment technology company offering wealth personalization infrastructure for enterprises including RIA platforms, Broker-Dealers, Asset Managers, and Fintechs. Their goal is to empower these companies to build scalable advisor workflows and highly personalized client investment experiences.

BridgeFT’s client is an emerging, pre-seed wealthtech startup aiming to disrupt the traditional investment management market by developing innovative, AI-powered investment technology. During their pre-product phase, their team began preliminary development of tax-smart rebalancing tools and portfolio construction capabilities designed to unlock greater investment personalization. Their goal was to create a tax-optimized, household-level set of integrated applications, so multi-custodial client and investment account data across households quickly became table stakes in order for them to create product differentiation and deliver more accurate analysis for their clients. If they hadn’t found an experienced and tech-forward provider, they would have had to build their own interfaces and processes for data ingestion, aggregation and normalization—wasting precious development time and resources on capabilities that would not improve their platform’s overall functionality.

The startup needed access to accurate, high fidelity data which would allow them to power a truly differentiated tax-smart solution. Their Co-Founder and Head of Growth explained, “At the time, we were pre-product but knew our target end-user would be multi-custodian by requirement. We had a data problem and we needed to solve it in the most efficient, scalable and cost-effective way. Originally, we planned to do automated document reading to extract data from custodial documents. However, once we learned about BridgeFT’s single API access point reducing the friction for clients to use our technology, we were sold.”

“Once we learned about BridgeFT’s single API access point reducing the friction for clients to use our technology, we were sold.”

When it came to considering other data aggregation providers, other providers were not able to provide tax lot level data at the specificity and scope that they needed, making BridgeFT’s WealthTech API the clear choice. In addition, with rapid growth projected, BridgeFT’s build-once to the API, accessmany approach offered them access to essential connections to many more custodians and back office data sources—all without having to build cumbersome data infrastructure each time they bring on a new advisor relationship.

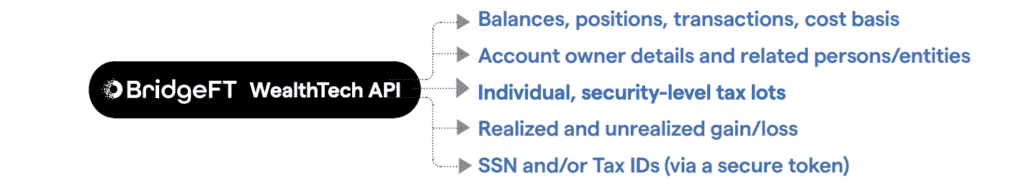

Depth of data was a crucial consideration for the startup to allow their models to be more accurate and deliver greater tax-aware personalization. Here are just a few of the data points they access via the WealthTech API:

In order to explore the possibilities of the WealthTech API, their team first gained access to BridgeFT’s Developer Sandbox to jumpstart the development of their initial proof of concept. Using the API, they began building towards specific use cases and doing pre-development integration to set themselves up for success when they secure their first client. During this pivotal period, the BridgeFT team provided developer-to-developer support, answering questions around use cases and providing details on the API endpoints. The startup’s team was able to build and validate their first proof of concept using simulated Schwab and Fidelity data available in the sandbox.

Their Head of Growth added, “The technical implementation with BridgeFT was incredibly smooth— the API docs are extremely comprehensive and technical support was provided immediately. Overall, it was a seamless process.” Their team quickly discovered that the WealthTech API was able to provide the depth of data needed to power their platform. Having tax lot level data was the secret ingredient that fed into their engine powering informed decisions on what lots to sell and helped with overall optimization from a trading perspective.

Not only did the WealthTech API provide the fuel to power the startup’s core functionality, it enabled their team to realize their mission of providing the highest degree of personalization in investing. Their Founder and Head of Investments & Quantitative Analytics said, “We believe you should be able to build a model at the client level. No other company can cater to models at the client level with preferences and risk tolerances. The reason we can do this is because of the multi-custodial data provided by BridgeFT. We can assemble the data as a unit from the household, and as a result, we have a very strong risk engine. On top of this, performance data from BridgeFT enables ongoing reporting.”

When asked what they find most unique about the WealthTech API, their Head of Growth said, “it gives us a life history of the portfolio—not just what the current portfolio is holding for the current account. It shows the positions history and the tax lots which is very critical for our platform. We need to understand the cost basis related to the tax lots and BridgeFT allows us to do just that, which is tremendously powerful.”

“We need to understand the cost basis related to the tax lots

and BridgeFT allows us to do just that, which is tremendously powerful.”

Access to the WealthTech API also had a significant impact on the startup’s strategy. Their own original proof of concept was a front end tool for advisors, but the API-first approach made them want to commit to wealth infrastructure. Their team opted to also offer componentized tools—allowing their target customers more flexibility—with all capabilities available via a single API.

Their Founder explained, “We built a high-performing tax intelligence application and realized our team can create algorithms quickly and effectively. However, with our original go-to-market strategy of working directly with RIAs we would have required a large service team. BridgeFT’s WealthTech API helped us deploy an API-first strategy which allows us to have a much larger capacity. This resulted in our revised strategy which is highly scalable.”

Throughout their deployment of the WealthTech API, the BridgeFT team has gone above and beyond to ensure the success of the startup’s team in all facets of their product development and ongoing enhancement. Their team sees the BridgeFT team as an extension of their own internal development resources. Their Founder agreed, “If there is something we need done urgently it gets taken care of immediately. Each one of BridgeFT’s team members is phenomenal and proactive with any opportunity we want to jump on.”

“If there is something we need done urgently it gets taken care of immediately. Each one of BridgeFT’s team members is phenomenal and proactive with any opportunity we want to jump on.”

When asked what the biggest impact has been for their company in working with BridgeFT, their Head of Growth said, “With BridgeFT we can aggregate all of our client accounts across custodians on a daily basis. This allows us to offer three key capabilities: tax intelligence, direct indexing, and rebalancing. No other provider in the market does all three effectively. And we’ve unlocked the capacity to offer this in a single platform because of BridgeFT’s WealthTech API. If it weren’t for the API, our clients would have to deal with custodial aggregation on their end.”

For more information about BridgeFT’s WealthTech API, contact at sales@bridgeft.com