Company Description

Income Lab provides financial advisors with cutting-edge software for ongoing retirement income management and client engagement. Advisors use Income Lab to give clients targeted, customized advice about how much they can spend, when and how to adjust spending for evolving economic and market conditions, and how to optimize distribution plans for tax efficiency. Income Lab was named “Best in Show” at the 2022 XYPN Advisor Tech Expo and was the “Highest-Rated Retirement Distribution Planning Tool” in the 2023 T3/Inside Information Advisor Software Survey.

Executive Summary

The Income Lab team was faced with a common decision: build custodial data feeds one-off with each custodian directly, or work with a trusted provider for multi-custodial aggregation. Income Lab selected to work with BridgeFT, deploying their WealthTech API. Using the API, the Income Lab team drastically shortened development timelines and supplied their platform with mission-critical custodial data from Schwab, TD, and Fidelity via a single data integration point.

Income Lab makes accessible impactful retirement tools for advisory firms of all sizes–large and small. Access to multi-custodial data was critical to Income Lab’s ability to acquire new advisors and successfully onboard them to their platform. This data was also essential for powering their planning tools with on-time, accurate account information. The Income Lab team was faced with a common decision: build custodial data feeds one-off with each custodian directly, or work with a trusted provider for multi-custodial aggregation.

“If we weren’t connected with BridgeFT, we would have had to go direct to each custodian, which would have extended our timeline to have a solution available for our users.”

Income Lab CTO, Manuel Balderas, explained “If we weren’t connected with BridgeFT, we would have had to go direct to each custodian, which would have extended our timeline to have a solution available for our users.” By selecting to work with BridgeFT’s WealthTech API, the Income Lab team drastically shortened development timelines and supplied their platform with mission-critical custodial data from Schwab, TD, and Fidelity via a single data integration point. BridgeFT’s WealthTech API brings in important investment accounts for clients, which make up a significant portion of a client’s retirement plan. This process keeps the accounts up to date, which brings to life the automated plan monitoring feature inside Income Lab.

Powering the financial planning process with on-time, automated multi-custodial data affords end-users of Income Lab’s platform a multitude of benefits including:

- More holistic planning for better long-term engagement

- Reduction of manual data entry

- Automation to improve advisor productivity

- Actionable and timely data for better planning and financial results

- Single view for advisor and client of the whole financial picture

- Accelerated client onboarding and higher client engagement

While offering embedded custodial data in financial planning platforms has been historically rare–it doesn’t have to be time-consuming or costly with BridgeFT’s WealthTech API.

Justin Fitzpatrick, Income Lab’s CIO, summarized, “BridgeFT’s on-time multi-custodial data combined with the robust features of Income Lab helps advisors answer critical questions around retirement like, ‘How much can I spend?’ or ‘Will I be okay if things change?’” The WealthTech API has effectively closed data gaps and allowed Income Lab to get up and running well with certain integration partners quickly. BridgeFT’s support team has worked hand-in-hand with Income Lab to successfully onboard new advisor accounts as well as troubleshoot any issues that arise for users. The WealthTech API and BridgeFT support team eliminate the need for Income Lab to have an in-house specialist to maintain/update data feeds.

In addition to eliminating the need for in-house staff, the WealthTech API provides a cost-effective, scalable solution to data aggregation–allowing Income Lab to keep its platform affordable for advisory firms of all sizes. WealthTech API offers an economical option to organizations that don’t want to pass on inflated costs to their end users.

“Rather than focusing our planning and time on data integrations, the WealthTech API has allowed our team to spend more time talking about Income Lab and providing value to our advisors.”

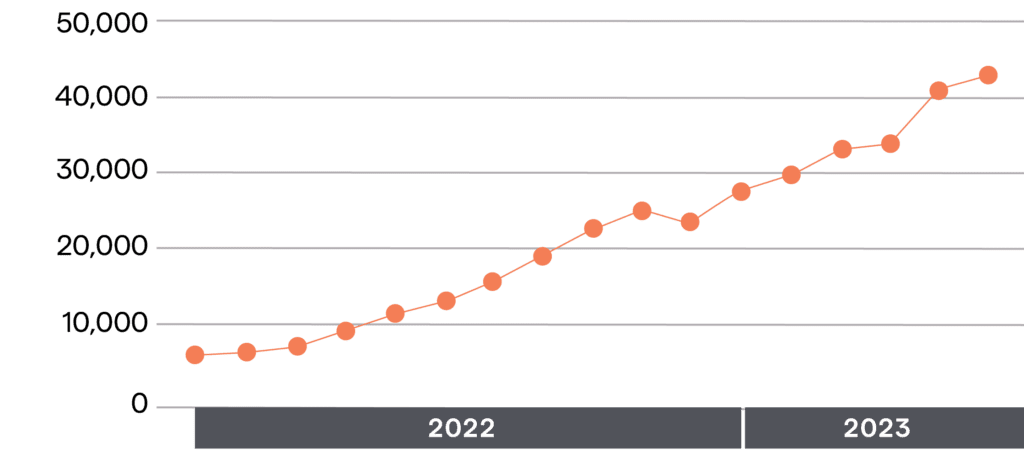

Perhaps the biggest value to the Income Lab team has been the time gained to focus on their product. Fitzpatrick said, “Rather than focusing our planning and time on data integrations, the WealthTech API has allowed our team to spend more time talking about Income Lab and providing value to our advisors.” Moreover, Income Lab has grown its advisor account coverage exponentially with the WealthTech API. Between 2022 and 2023, the account coverage provided by WealthTech API grew 400%–for a total of over 40,000 accounts processed.