Custom Indexing and Thematic Portfolio Construction Platform Leverages Multi-Custodial Data from BridgeFT to Fuel Highly Personalized Investment.

Company Overview

ALLINDEX, a Switzerland-based FinTech with US presence, is a custom indexing and thematic portfolio construction platform helping to create personalized financial exposures. ALLINDEX’s white-label technology enables financial advisors, investment managers and end clients to get to the allocation they are seeking. They can get there by selecting from existing models or products which fit their preferences. Alternatively, they can create customized portfolios or rule-based strategies by starting either from existing/standard indices or entirely new universes, some of which are generated with machine learning. These bespoke allocations eventually can serve as underlyings for separately managed accounts, ETFs or structured products.

Bringing Their Vision to Life

ALLINDEX, a high-growth, global fintech startup, is pioneering the democratization of direct indexing with the bold vision of bringing personalized investing to more than just the ultra-wealthy who are currently serviced, almost exclusively, by established players. With this primary objective, they’ve built a comprehensive and user-friendly investment platform which they deliver to clients on a white-labeled, software-as-a-service (SaaS) basis in either a B2B and/or a B2B2C fashion. With proven success in Europe and APAC and traction with several clients in the US, ALLINDEX eyed accelerated expansion into the ever-growing US wealth management market. However, before bringing their complete solution to the US, they knew they needed to find a trustworthy and fast-moving data partner who understands the unique aspects of custodian data and who could help accelerate their strategy. The ALLINDEX team was eager to bring their unique vision to life for financial advisors and other ecosystem partners in the Wealth Management space.

Aladár Tepelea, ALLINDEX Head of EMEA and APAC explained, “We are bringing the future of custom indexing as a white-label solution. Other product-oriented providers have a large shelf of standardized products which they try to push on as many clients as possible, in order to create scale. ALLINDEX turns it around by enabling every client to get exactly what they want in their investments by putting together their unique exposure according to their values and needs. It’s a tectonic shift from standard options provided to many clients towards everyone getting their own, fully-personalized allocation.

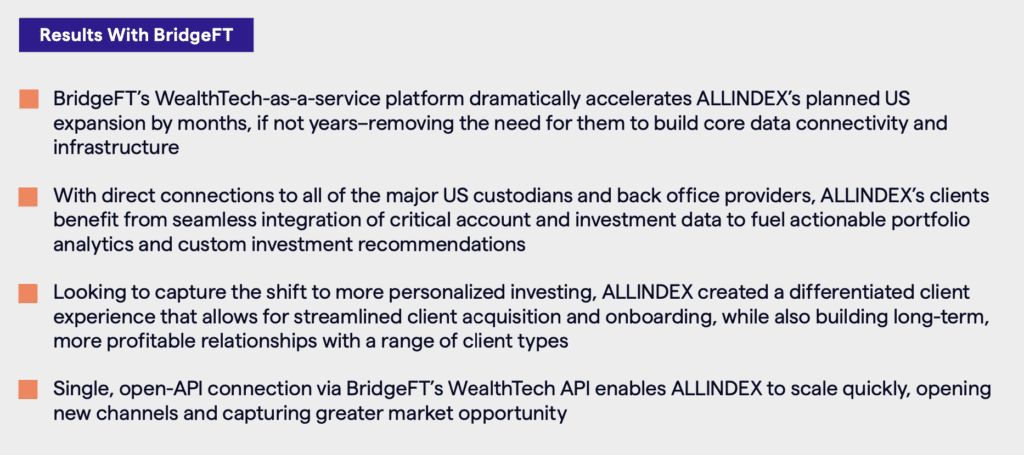

In order to bring the future of custom indexing to market, ALLINDEX selected BridgeFT’s WealthTech API, a WealthTech-as-a-service platform, as their primary source for data aggregation to help bring their vision to life. ALLINDEX chose BridgeFT based on their industry expertise, modern API technology, and overall cost-effectiveness. Christian Kronseder, CEO, added, “In prior roles, I had to work directly with custodians to build individual connections. Setting up connectivity to multiple providers with legacy infrastructure is a very big undertaking and the work BridgeFT has done as our aggregator reduced our time to market by months, if not years. We didn’t have the resources or time, hence we are happy to go to BridgeFT, a versatile solution provider.”

BridgeFT provides ALLINDEX with connectivity to all of the major custodians and back office providers, enabling their users to automatically bring in essential account and investment data that allows them to create portfolios from scratch, or use existing indexes as they see fit. Christian said, “With BridgeFT as our underlying infrastructure, we can leverage additional information that’s available which enhances

our capabilities. It nicely compliments our product offering and creates a user experience that resonates with customers, especially when it comes to financial advisors for whom connectivity to custodian data is essential.”

Beyond access to data, BridgeFT also offers ALLINDEX clients a one-of-a-kind experience via our fully integrated WealthTech ecosystem. ALLINDEX’s Head of the Americas, Henry Ann, emphasized, “Our clients get very excited when they see ALLINDEX is connected to an ecosystem of wealth management solutions.” He added, “BridgeFT is seen by our clients as the spoke—the connection to several steps in their wealth management journey.” With BridgeFT’s WealthTech API powering their platform, ALLINDEX is now able to make the future of personalized indexing even more convenient for financial advisors and WealthTech service providers.

Aladár explains, “Historically, the discussion around direct indexing has had a strong tax-loss harvesting focus. ALLINDEX is offering that, plus we also help clients benefit from the other investment angles which will become more important in the future of direct indexing. I am confident that, increasingly, demand will focus on personalization via a user-friendly and scalable interface, with an emphasis on topics like values- based investing, ESG, thematic investing, and bespoke tilts for specialized strategies. With our scalable platform, and the various partnerships we have struck, ALLINDEX is ready to support this future in our industry.”